The Fractional Banking System _____

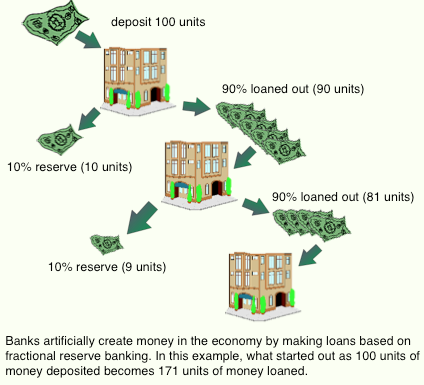

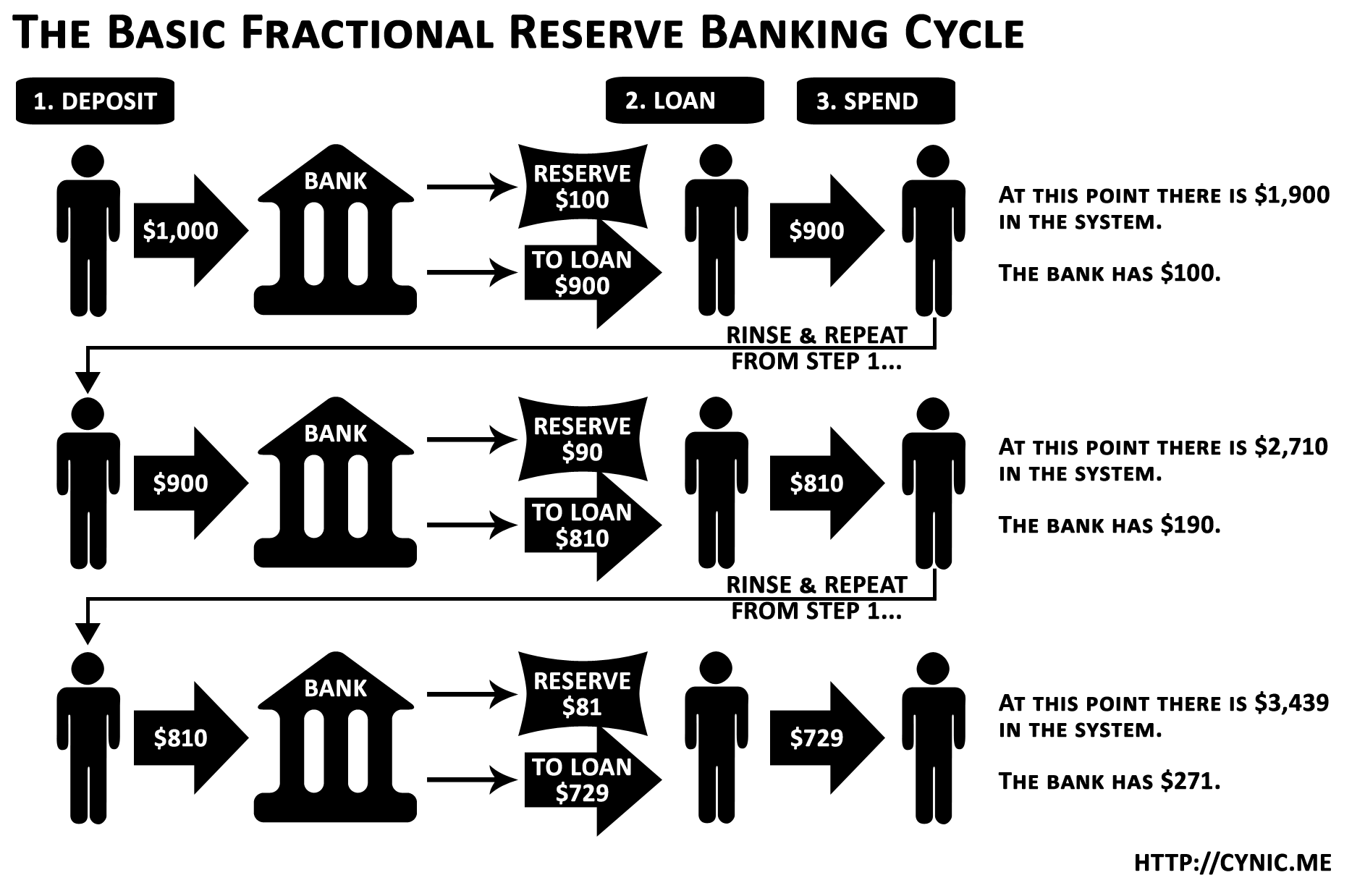

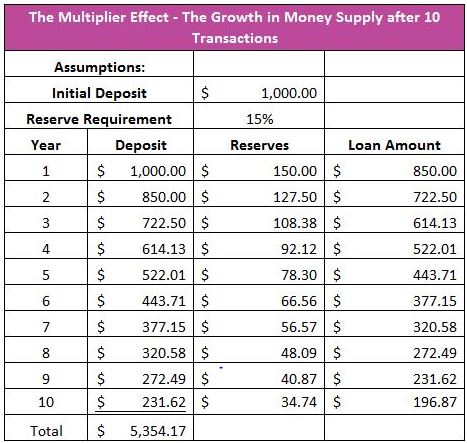

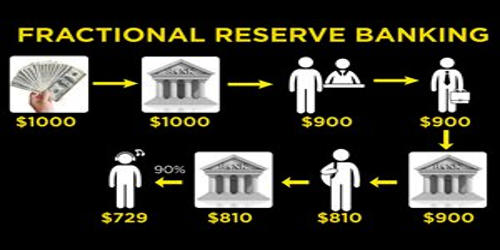

The fractional banking system _____. This allows them to use the rest of it to make loans and thereby essentially create new money. If they did the entire banking system would collapse. Under a fractional reserve banking system banks are not required to maintain 100 of their customers deposits in their reserves.

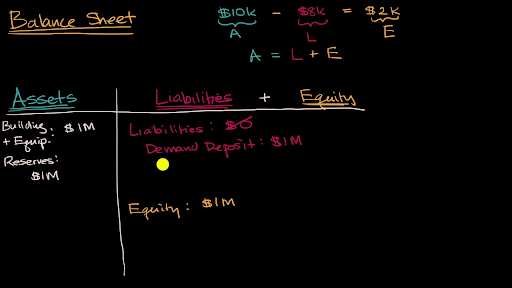

The fractional reserve banking is the system where the bank make loans while holding certain fraction of it liabilities. I think one of the important benefits of fractional reserve banking is it pools together a lot of smaller savings and its able to lend it out in a variety of markets some of them to big business but also to smaller enterprise and to householdsinstitutions that banks because of their location because of their understanding of the needs of the small business and the needs of. The fractional banking system a.

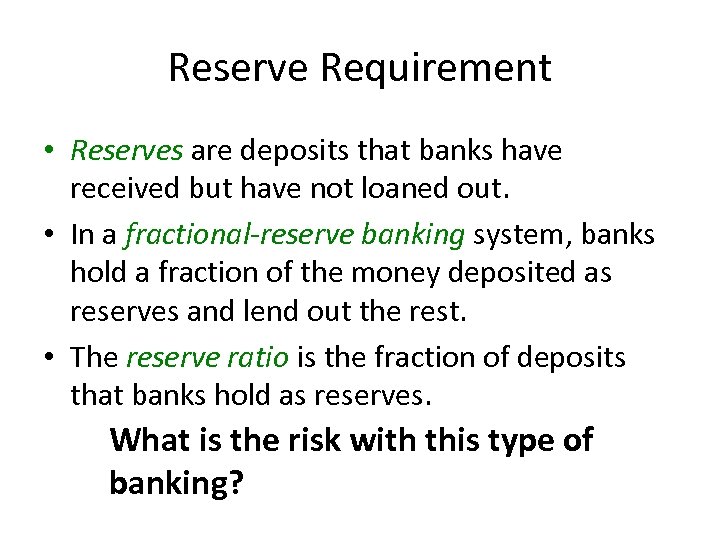

While this system is the most popular commercial banking arrangement it is not without risks. Fractional reserve banking is a system in which only a fraction of bank deposits are backed by actual cash on hand and available for withdrawal The theory behind this idea is that it can expand the economy by freeing up capital for lending giving more growth opportunities. Banks used to maintain as much as 60 of their deposits in reserves.

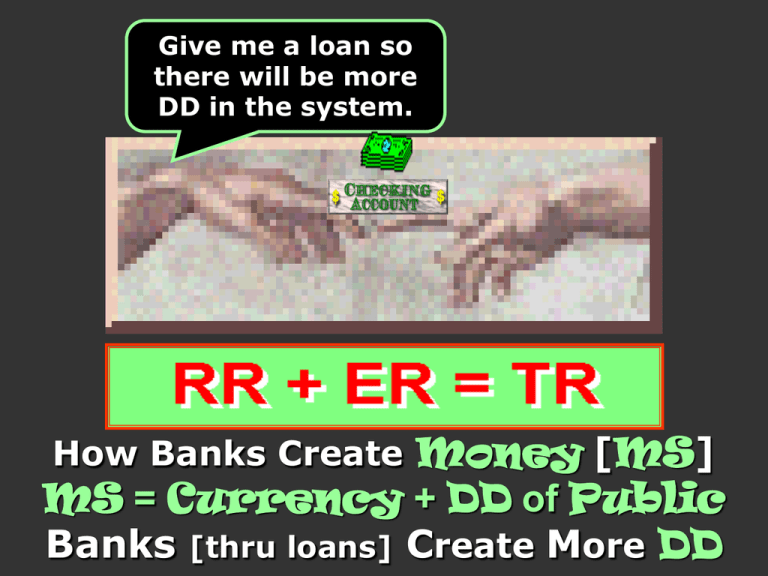

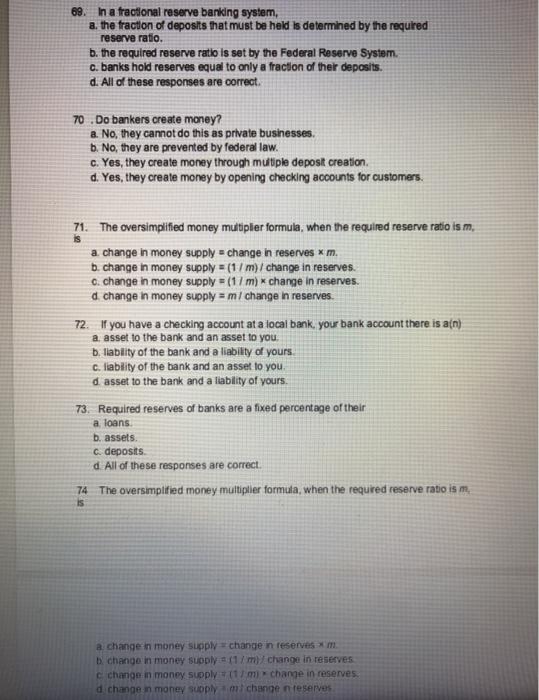

In a fractional reserve banking system banks keep a fraction of deposits as reserves and use the rest to make loans. Only works if there are a limited number of banks c. Fractional reserve banking is a banking system in which banks only hold a fraction of the money their customers deposit as reserves.

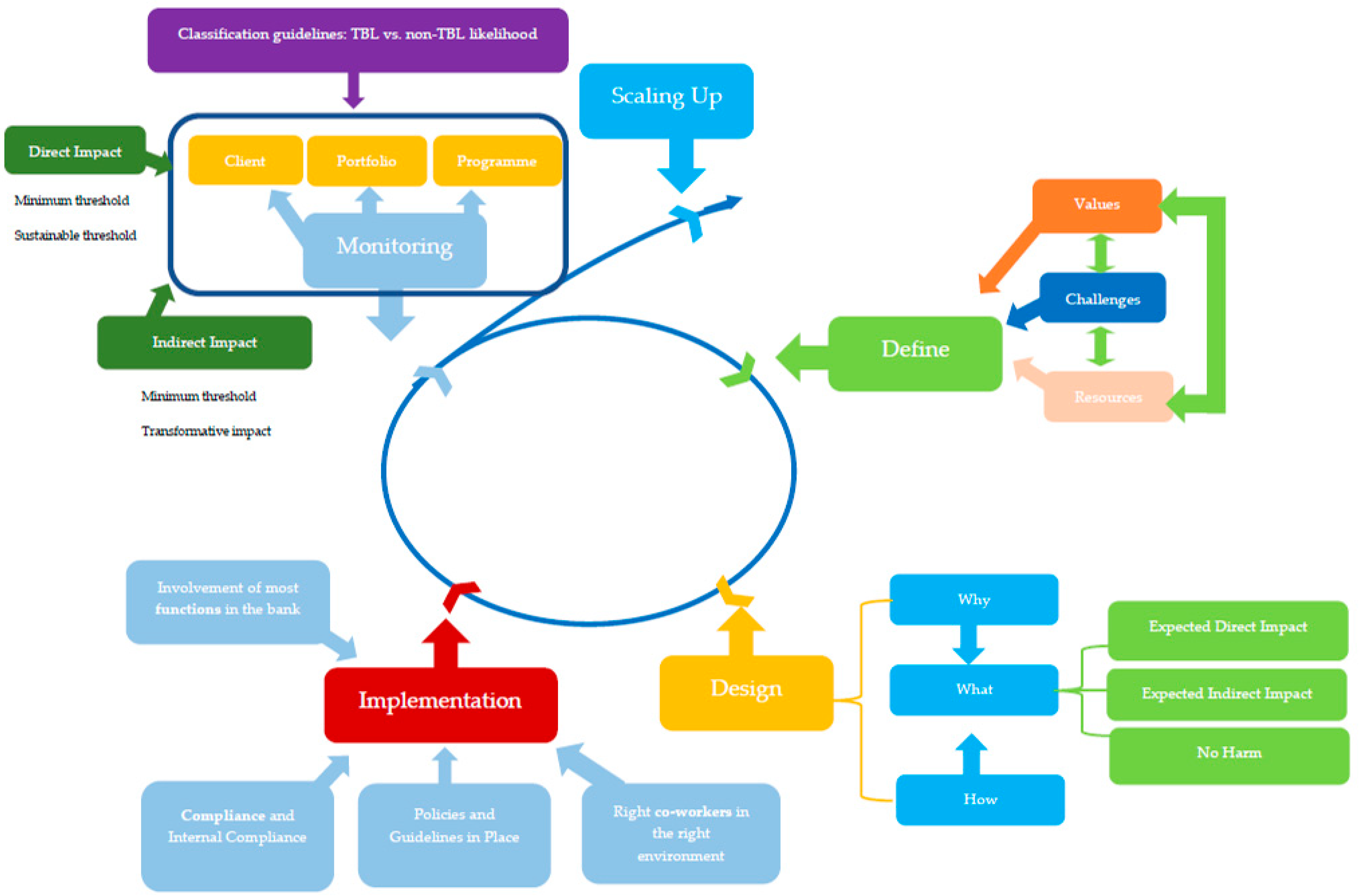

What is the role of the Federal Reserve System in regulating and stabilizing the commercial banking system. Makes banking more secure b. How Fractional Reserve Banking Works When you put your money into a bank the bank is required to keep a certain percentage a fraction of that money on reserve at the bank but the bank can lend the rest out.

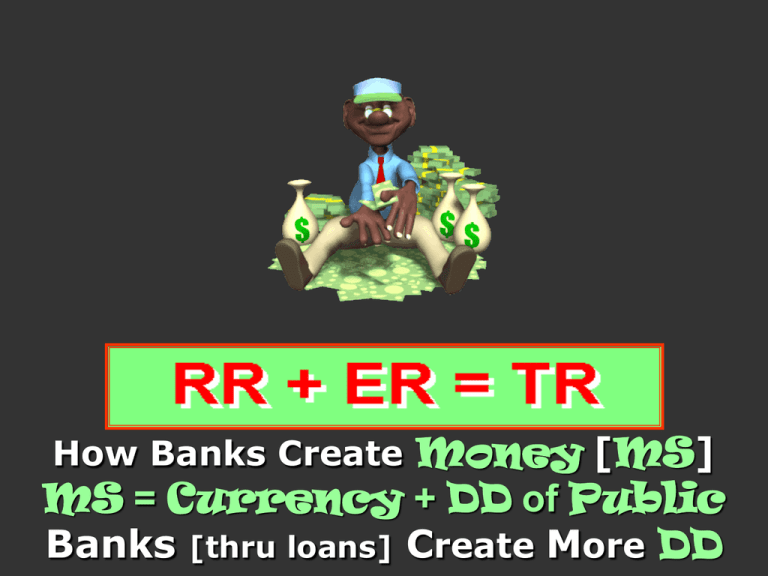

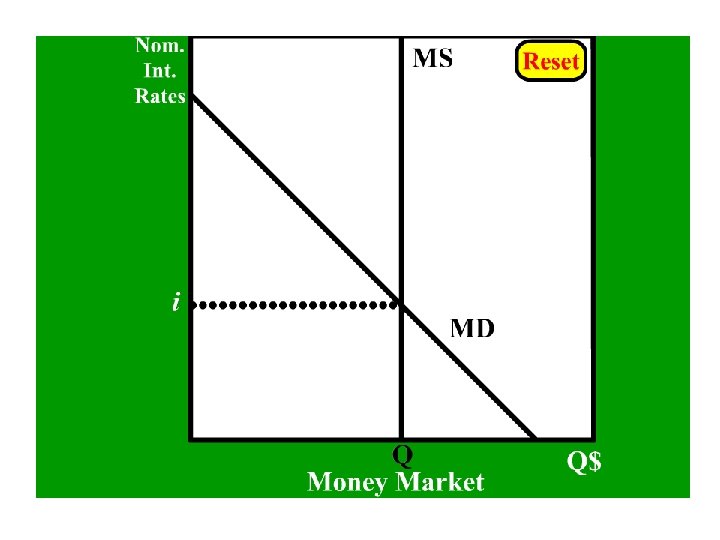

Referred to as the fractional reserve system it permits the banking system to create money. Fractional reserve banking is a banking system in which banks hold a fraction of their clients deposits in reserves. This gives commercial banks the power to directly affect the money supply.

What are true statements about the history of the fractional banking system. Ensures growth in the economy d.

This system is the way that virtually all modern day banks around the world operate.

A system in which banks hold reserves whose value is less than the sum of claims outstanding on those reserves is called a fractional reserve banking system. Fractional reserve banking is a banking system in which banks hold a fraction of their clients deposits in reserves. Ensures growth in the economy d. I think one of the important benefits of fractional reserve banking is it pools together a lot of smaller savings and its able to lend it out in a variety of markets some of them to big business but also to smaller enterprise and to householdsinstitutions that banks because of their location because of their understanding of the needs of the small business and the needs of. What are true statements about the history of the fractional banking system. What is the role of the Federal Reserve System in regulating and stabilizing the commercial banking system. This gives commercial banks the power to directly affect the money supply. This provides capital that could be loaned to. The fractional banking system is a banking system in which banks keep only a fraction of the amount of their customers deposits as a reserve - either as liquid money or other documents of high liquidity - while having the obligation to return those deposits in demand that is in new loans for their clients.

Ensures growth in the economy d. This modern banking system is used throughout most of the world in some form or another. The fractional banking system is also known as the fractional reserve banking system. Makes banking more secure b. Fractional reserve banking is a banking system in which banks only hold a fraction of the money their customers deposit as reserves. A system analysis of the basel capital accords regulatory control over the behaviour of modern banking systems By jacky mallett Threadneedle. In a fractional reserve banking system banks actually only maintain a small amount of their deposited funds in reserve forms of cash and other easily liquid assets.

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Post a Comment for "The Fractional Banking System _____"